Buy A Home With Habitat

For more details scroll down past the pre-application.

Habitat partners with families and individuals to help build a place they can call home. Potential homeowners work alongside volunteers to help build their own homes, which they then purchase with an affordable mortgage. Through financial coaching, homebuyer training, and partnership hours, your family can pursue purchasing a home of your own. Habitat works with third-party lenders to offer low interest rates and down-payments on our mortgage packages. Review the selection criteria below to determine if Habitat homeownership is the right path for you.

Are you interested in Homeownership in Pittsfield or Housatonic?

CRITERIA FOR SELECTION

RESIDENCY

You must have lived or worked in Berkshire County for at least the past year.

NEED

You must not have owned a home in the past 3 years and currently be living in substandard, subsidized, or unaffordable housing.

ABILITY TO PAY

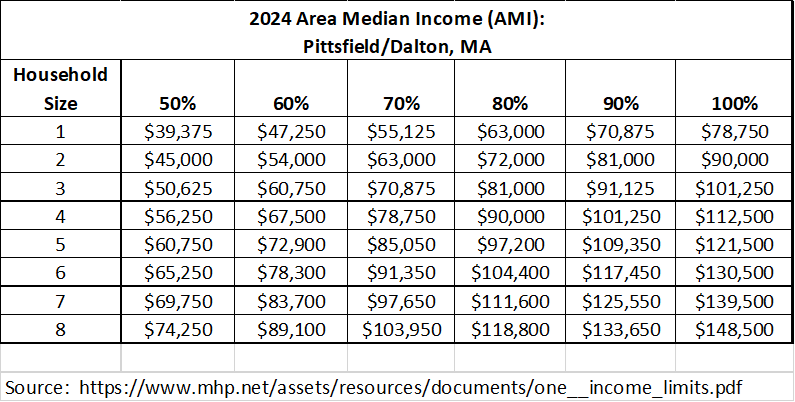

You must be able to obtain a mortgage pre-approval from a third-party lender whose information can be provided by Habitat. Your total household income must also meet the income guidelines of the town in which you are interested in applying for homeownership. These Area Median Income ranges are configured by household size and will vary depending on the town – Pittsfield, Dalton, or Housatonic.

If you are unable to qualify right away for a mortgage loan, Habitat is happy to work with you by guiding you through our free financial education classes and working with our financial coaches to prepare you for successful homeownership.

Asset restrictions apply – total household asset cannot exceed $75,000.

WILLINGNESS TO PARTNER

One of the most cherished aspects of the Habitat homeownership journey is the opportunity to actively participate in building your own home. By working with our Habitat Build & Repair Corps and dedicated volunteers, you’ll not only witness the construction of your home but also gain hands-on experience and valuable tips for maintaining every aspect of your home’s construction. Volunteers often share their expertise and stories, enriching the experience and building meaningful connections along the way. This collaborative process becomes the foundation of your homeownership journey, creating lasting skills and memories.

This program, known as “partnership hours,” requires families to complete between 275 and 425 hours of volunteering, depending on whether you are a single or dual head of household. These hours include participating in homebuyer financial education classes, which are designed to set you up for long-term success. These classes cover vital topics like securing a mortgage, improving your credit, budgeting, and understanding inspections and insurance. Income and asset restrictions apply, but this program provides a comprehensive path to stable, affordable homeownership and a stronger future.

To receive more information please complete the inquiry form or call our office at 413-442-3181 ext. 2.

Title VI prohibits discrimination on the basis of race, color, and national origin in programs and activities receiving federal financial assistance. Section 504 prohibits discrimination based on disability in any program or activity receiving federal financial assistance. If you or anyone has suffered against housing discrimination click here to file a complaint.

Title VI prohibits discrimination on the basis of race, color, and national origin in programs and activities receiving federal financial assistance. Section 504 prohibits discrimination based on disability in any program or activity receiving federal financial assistance. If you or anyone has suffered against housing discrimination click here to file a complaint.